US Supreme Court strikes down Trump’s tariffs

21st Feb 2026

Read

TABLE OF CONTENTS

- The Supreme Court's Ruling

- Alternative Legal Routes for Tariffs

- Implications for Global Trade

- Conclusion

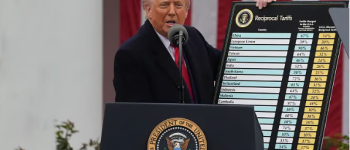

News- The Supreme Court of the United States delivered a 6-3 verdict striking down sweeping tariffs imposed by former President Donald Trump under the International Emergency Economic Powers Act (IEEPA).

| Background: IEEPA and Trump's “Liberation Day” Tariffs The International Emergency Economic Powers Act (IEEPA), 1977 was enacted by President Jimmy Carter, replacing the Trading with the Enemy Act (1917). The Act authorises the US President to take economic measures against any “unusual and extraordinary threat” originating substantially outside the United States, provided a national emergency is formally declared. Historically, IEEPA has been used for:

Crucially, no President prior to Donald Trump had interpreted IEEPA as granting authority to impose blanket import tariffs. On April 2, 2025, President Donald Trump invoked IEEPA to declare a “national emergency” arising from what he termed unfair foreign trade practices, persistent trade imbalances, and the absence of reciprocity in trade relations. Under this declaration, he imposed sweeping reciprocal tariffs on nearly all US trading partners - a move described by the administration as “Liberation Day.” |

The Supreme Court's Ruling

When the Supreme Court of the United States delivered its 6-3 verdict, the central message was clear: the President cannot create tariff powers where Congress has not clearly granted them.

What Did the Majority Say?

Writing for the majority, Chief Justice John Roberts essentially argued that:

- If Congress wants to give the President the power to impose tariffs, it must do so clearly and explicitly.

- The International Emergency Economic Powers Act (IEEPA) does not mention tariffs anywhere.

- Declaring a “national emergency” does not automatically allow the President to impose unlimited economic measures.

- Executive power must remain within the boundaries set by law.

In simple terms, the Court reminded the government that taxation and tariff powers belong primarily to Congress under Article I of the US Constitution, and cannot be assumed by the Executive through broad interpretation.

The Dissenting View

Justice Brett Kavanaugh, however, disagreed. He argued that:

- The ruling would not permanently weaken presidential tariff powers because other legal routes are available.

- The immediate effect of the judgment could create confusion and administrative difficulties.

- Refunding billions of dollars already collected from importers could turn into a legal and bureaucratic “mess.”

Thus, while he accepted the practical consequences might be complicated, he believed the broader impact on executive authority would be limited.

What the Judgment Does NOT Do

Importantly, the decision is not a blanket rejection of tariffs.

- It does not invalidate all Trump-era tariffs.

- Tariffs imposed under other laws - such as Section 232 (national security) and Section 301 (unfair trade practices) - remain valid.

- It does not prohibit tariffs as a policy instrument.

The ruling simply states that IEEPA cannot be used as a shortcut to impose sweeping, across-the-board tariffs without clear Congressional approval.

Alternative Legal Routes for Tariffs

Even after the ruling, the Executive retains several statutory options:

| Legal Provision | Key Features |

| Trade Act, 1974 — Section 122 | 15% tariff for 150 days (balance-of-payments crisis) |

| Tariff Act, 1930 — Section 338 | Up to 50% tariffs on discriminatory nations |

| Trade Expansion Act, 1962 — Section 232 | National security-based import restrictions |

| Trade Act, 1974 — Section 301 | Action against unfair trade practices |

Trump immediately announced a 10% temporary global tariff under the Trade Act of 1974.

Implications for Global Trade

1. Stronger Constitutional Checks in the US- The ruling reinforces separation of powers by limiting the President's unilateral authority to impose sweeping tariffs without clear Congressional approval.

2. Short-Term Relief, Long-Term Uncertainty- While the blocked tariffs offer temporary relief to trading partners, alternative legal tools still allow the US to impose new tariffs, keeping uncertainty alive.

3. Impact on India and Other Exporters- Countries like India may seek refunds on earlier tariff payments, but sectors such as pharmaceuticals, textiles, electronics, and IT remain vulnerable to future US trade actions.

4. Shift Toward Strategic & Managed Trade- The decision reflects a broader global trend where major powers increasingly use tariffs as strategic tools, weakening the predictability of the WTO-based multilateral trading system.

Conclusion

The Supreme Court's decision is a major moment in US constitutional and trade law. It limits the President's ability to use emergency powers to impose large-scale tariffs. However, it does not end protectionist trade policies in the US. For India and other countries, the ruling provides short-term relief. But it also shows that global trade is becoming more strategic and politically driven, rather than fully based on predictable multilateral rules.

Source- IE

Author: Lemo

Lemo is the quiet observer of the UPSC world. He writes when the city sleeps, fueled by black coffee and the ticking clock. As the visionary behind Epoch IAS, he crafts notes that are short, sharp, and always a step ahead of the syllabus — trusted by aspirants burning the midnight oil.

Feel free to use images in our website by simply providing a source link to the page they are taken from.

-- Epoch IAS

Explore By Category

Latest Posts

Share views on US Supreme Court strikes down Trump’s tariffs

Please keep your views respectful and not include any anchors, promotional content or obscene words in them. Such comments will be definitely removed and your IP be blocked for future purpose.

21st Feb 2026

21st Feb 2026

20th Feb 2026

20th Feb 2026

19th Feb 2026

19th Feb 2026

18th Feb 2026

18th Feb 2026

18th Feb 2026

18th Feb 2026

10th Feb 2026

10th Feb 2026

10th Feb 2026

10th Feb 2026

9th Feb 2026

9th Feb 2026

7th Feb 2026

7th Feb 2026

6th Feb 2026

6th Feb 2026

6th Feb 2026

6th Feb 2026

31st Oct 2025

31st Oct 2025

30th Oct 2025

30th Oct 2025

29th Oct 2025

29th Oct 2025